Power customer contentment and also declares contentment rating, discounts and cost savings programs used, and each firm's track record for offering reduced prices when making these decisions. The very best car insurance policy firms in Pennsylvania according to our evaluations were: Contrast Automobile Insurance Business in Pennsylvania There are many factors to think about when choosing a car insurer.

Progressive likewise has various other advantages like online chat so you do not have to get the phone, and it likewise has actually an extremely rated consumer solution sustain team. This assisted the firm gain the top spot on our listing. 828 (No. 9 on the J.D. Power Pennsylvania Study) A+ (exceptional) $1,914 Space protection (loan/lease payback if you owe greater than the auto deserves)Rental car reimbursement (typically $40 to $60 each day)Customized components as well as devices value, Ride-hailing protection, Roadside support Name Your Cost Tool (enter your desired costs and also Progressive will design a policy)Photo application ($146 average annual financial savings)Package automobile and residential property (12% typical price cut)Multi-policy (5% ordinary discount)Multicar (12% average price cut)Little mishap mercy (your costs will not be elevated on a claim of much less than $500)Large mishap forgiveness (no premium boost in an accident if you have actually been a customer for a least five years without any crashes for the previous 3 years)Constant insurance coverage (discount rate varies)Teenager vehicle driver (18 or more youthful)Great trainee (discount rate differs)Distant trainees (more than 100 miles from house discount rate varies)House owner (ordinary discount virtually 10%)Online quote (7% ordinary price cut)Sign online (9% ordinary price cut)Paperless (discount rate varies)Pay completely (discount rate varies)Automatic repayment (discount differs) Liberty Mutual advertises personalizing your policy via its "only spend for what you require" slogan.

It provides a larger range of plan alternatives and also discounts than the majority of various other cars and truck insurer - auto. You can pick the alternatives that will work best for you and leave out the ones that won't. There are lots of discounts to help you obtain a low automobile insurance policy costs. 816 (No.

Having good vehicle insurance is around even more than just expense - cheapest car insurance. Often it's good to have a firm that supplies advantages and in fact pays individuals who drive safely.

And also while low-cost does not necessarily equivalent top quality, GEICO has the fourth-highest score in the state for customer claims and complete satisfaction and an AM Best ranking of A+, making it really likely cases payment corresponds. The firm likewise uses lots of insurance coverage choices, including ride-hailing as well as mechanical failure coverage. And also if that's insufficient, GEICO provides the deepest price cuts in the market (prices).

This provides you with the lowest premiums available based on the mix of choices you want and also the price cuts that use to you. Agile, Rates is a superb selection for chauffeurs who may have less-than-perfect driving accounts. That might include one or even more moving infractions, an at-fault mishap, poor credit scores or perhaps a citation for driving under the influence (cheaper car insurance).

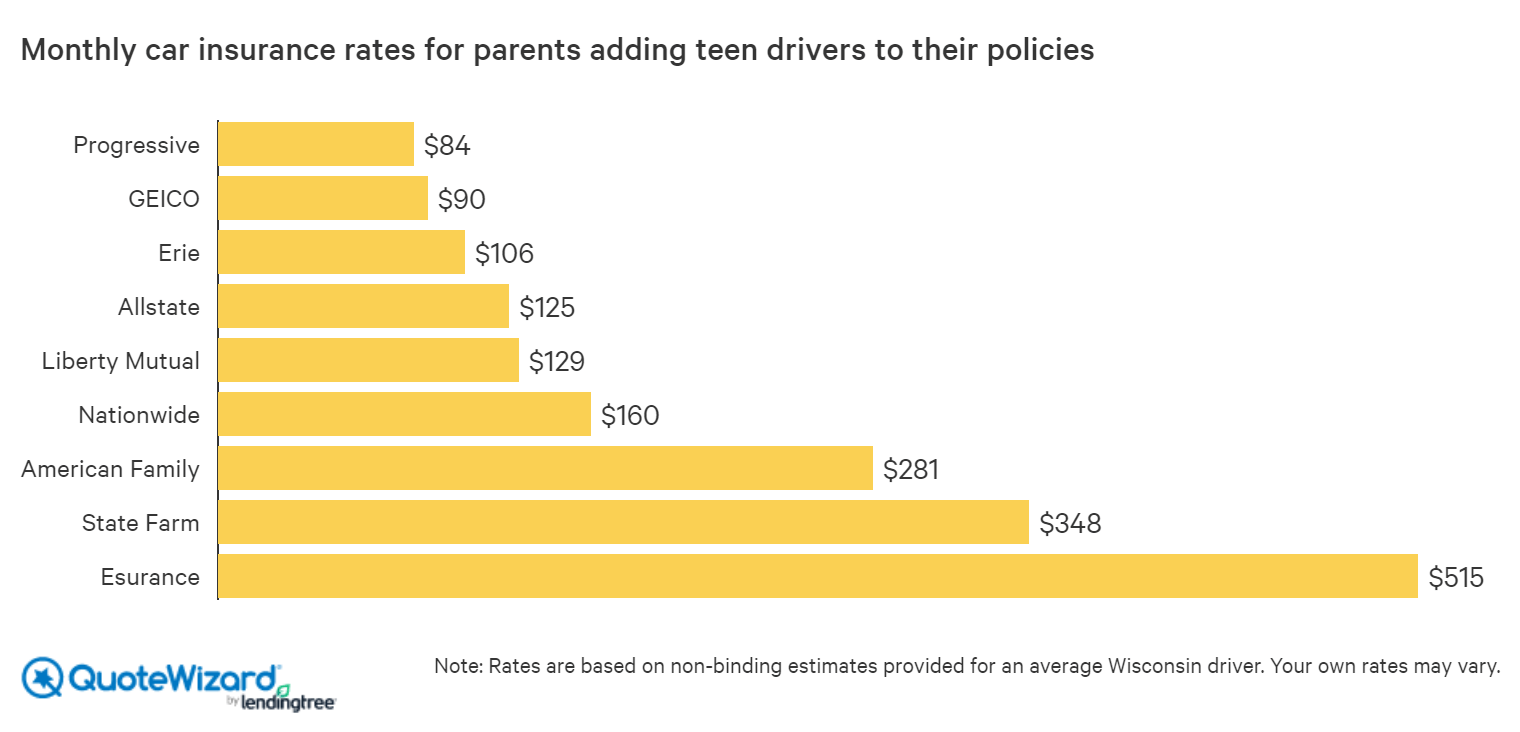

The Definitive Guide for Esurance Car Insurance Quotes & More

Just how We Chose the Finest Automobile Insurance Coverage Options in Pennsylvania Pennsylvania is a distinct state for vehicle insurance coverage. Even though it is a no-fault state (extra on that particular listed below), its typical costs are less than other no-fault states like Louisiana, Florida as well as Michigan. Still, we considered even more than simply cost when comparing car insurance options in Pennsylvania.

We looked into numerous various insurer' price cut offerings, advantages as well as programs, highlighting the ones that supplied something different or special (affordable). Another tool that allowed us to check numerous different accounts of drivers in Pennsylvania was . This site helped us test for chauffeurs with positive as well as unfavorable driving histories, plus motorists with a range of different credit history.

Full-tort no-fault insurance policy gives motorists the right to file a claim against various other vehicle drivers for expenses and pain here and also suffering in case of a mishap. Restricted tort restricts the choice to submit a suit after a crash but still needs a vehicle driver's own insurance provider to pay for clinical expenditures. This choice allows motorists to select an extra economical vehicle insurance choice if they desire.

vehicle insurance auto insurance insurance company prices

vehicle insurance auto insurance insurance company prices

suvs cheap car auto cheapest car insurance

suvs cheap car auto cheapest car insurance

Pennsylvania chauffeurs ought to likewise consider their own driving histories, needs and time restrictions when taking into consideration an auto insurance business. Some automobile insurance provider supply more advantages, like superb client service, easy cases declaring and also price cuts for risk-free driving. Nevertheless, sometimes rewards come with greater premiums (credit). For these reasons, motorists in Pennsylvania must access least five cars and truck insurance policy quotes, and study discounts as well as rewards provided at each business before selecting the finest auto insurance in Pennsylvania for them.

Texas law requires individuals who drive in Texas to spend for the mishaps they cause. To find out more about car insurance policy, have a look at our Car insurance guide. Some of the subjects consist of: Sorts of insurance coverages. Driving in various other states. Insurance coverage for young drivers. Actions to take after a crash. Recognizing rates.

Practically every state in America requires some kind of car insurance. That's why taking the time to find the best automobile insurance is so essential.

The Ultimate Guide To Car Insurance Costs Rise: How To Save When Renewing

insurance cheap insurance cheap laws

insurance cheap insurance cheap laws

1. Savvy Let somebody else search for you. Why not obtain quotes from a couple of different places to make certain you're getting the absolute ideal bargain on your auto insurance? A totally free web site called Savvy will certainly aid you discover the best prices in under 30 secs. It conserves people a standard of $826 a year.

car laws cars low-cost auto insurance

car laws cars low-cost auto insurance

Which's it! Smart is 100% totally free to utilize and provides immediate outcomes. According to Savvy, 40% of its individuals find a less expensive strategy than their present one. The only downside to Savvy is that you can't complete an application on the Smart website; you need to click over to the insurance provider's website or call to use.

It also supplies several types of insurance coverage so you can have all or a lot of your plans with 1 insurance provider. risks. On the whole, Allstate is an excellent selection and worth comparing with various other insurance firms to see if it's ideal for you. It's offered in all 50 states and also has an A+ score from AM Finest.

The firm has come a long way because its beginning, yet the mission continues to be the exact same - auto insurance. Safe as well as efficient transportation is precisely what AAA devotes to per the company's core declaration. AAA is most likely best known for its roadside support, however the business uses a variety of insurance protection and subscriptions.

State Ranch will certainly guarantee a traditional car as long as the supporting policies are with them as well. State Ranch has a manner in which every vehicle driver can save, from earning excellent grades as a trainee motorist to incorporating your automobile plan with your homeowners insurance. Best For Rideshare drivers 6 (affordable auto insurance).

Several of the distinct functions of the program can help you save cash on your plan with time, especially if you have and also preserve a tidy driving document. This strategy is best for AARP members that are secure motorists and aiming to conserve some cash on their costs consequently (accident).

Not known Factual Statements About Compare 2022 Car Insurance Rates - Getjerry.com

Best For Constant tourists that understand the value of high quality rental automobile insurance Vehicle owners as well as non-owners that require liability protection Cost-conscious drivers Without insurance motorists that are accredited to drive as well as want to insure a rental vehicle Pros As much as $35,000 in insurance coverage in primary and second responsibility insurance 24 hr customer solution Normally more affordable than rental automobile coverage at the rental desk Online quotes as well as insurance claims Cons Should buy in advance Main Types of Car Insurance Coverage Coverage Insurance is governed at the state degree, so while lots of basic protections will be similar, there are some different methods on coverage options, relying on the state in which you live. low cost auto.

Car Med Pay is initially, Uninsured or Underinsured Vehicle Driver Physical Injury & Residential Property Damages Coverage, Shields you from without insurance or underinsured vehicle drivers In some states, In some states, You and your guest(s)'s clinical expenditures, shed earnings, and also pain and also experiencing * If you do not have this protection on your lorry, you may not have coverage for it. risks.

Might or may not have a deductible, depending on your policy * Differs by state and carrier. Examine your state legislations and insurance policy carrier's demands for particular information. What Impacts Cars And Truck Insurance Rates? Insurance coverage is the transfer of danger from a private to a swimming pool of individuals. To make the math job, insurer require to comprehend the danger you stand for relative to the pool.

Debt, Driving history, Where you live, The sort of vehicle your drive, The number of miles you drive, Your driving experience, Sex, Age, Home ownership, Current claim fads, Geographic trends like regulations or weather condition in a location: Insurance policy firms have located a connection in between credit rankings as well as the risk of a claim for all major insurance coverage kinds.

It's typical for insurers to weigh mishaps in the previous 5 years and tickets or violations in the past 3 years. Urban areas have much more automobiles on the roadways to bump into and a lot more disturbances.

Also, the security attributes or crash ratings of a particular kind of automobile influence rates.: Every mile driven is a mile in which you could be associated with a crash. Some insurance companies provide a discount rate for reduced mileage motorists. If your mileage use is well over the average of about 15,000 miles per year, some insurers will charge much more.

The Buzz on Esurance Car Insurance Quotes & More

Some insurance companies won't even compose a plan for a vehicle driver with much less than 3 to 5 years of driving experience. Usually, men will certainly pay greater than ladies, especially if they're younger. More youthful chauffeurs will certainly pay more than older motorists. Different insurance providers start to provide cost breaks at various ages. insurance.

Others begin at age 25, or even 30. Some insurers will certainly also charge a lot more for chauffeurs over the age of 70 (insurance affordable). Insurance provider typically give lower rates to home owners since they have discovered a relationship in between homeownership as well as lowered danger. You can additionally pack your property owner's insurance.: It's not unusual for an insurance company to raise rates in a state adhering to an event that produces a surge in insurance claims, like a large storm.

What is Not Covered by Auto Insurance Policy? Also the best automobile insurance coverage plan will not cover every little thing (perks).

You wish to get in touch with your insurance agent or carrier. In addition, if the rental cars and truck is harmed, you will certainly not be covered for "loss of usage" when the rental company can't rent the vehicle to another person due to the fact that it is being repaired, or for "decrease", which is the loss of worth for the rental auto even after it is fixed.

With some insurer, they are able to add an extra endorsement to the automobile plan to cover rideshare (cheap insurance). Inspect with your insurance representative or carrier to see if this is a choice. Personal effects (laptops, phones, etc) harmed in a crash or stolen from your vehicle might be by your vehicle insurance plan.

You desire to talk to your insurance coverage company. If you have a house owners or renters insurance policy policy, you might have the ability to put an insurance claim keeping that policy, based on your insurance deductible. f you establish fire to your cars and truck, the insurer will not pay to fix or replace your cars and truck.